Here’s the truth: while North America, Europe, China, and South Korea were already soaring with their esports scenes in the early 2010s—thanks to popular PC titles like League of Legends, Dota 2, and Counter-Strike—Southeast Asia was still dreaming.

Dreaming of a day when the region could reach those same heights. Dreaming of million-dollar prize pools. Dreaming of pro players who’d become household names, as famous as television celebrities.

Then came 2017. A shift. The spark that lit the fuse. That year marked the beginning of a new chapter—a chapter where Southeast Asia didn’t just catch up, but carved out its own path. A chapter where mobile esports weren’t just an alternative—they became the main stage.

Today, we’ll look at the key reasons why Southeast Asia has emerged as the beating heart of mobile esports.

Affordable Smartphones: A Gateway to Gaming

Esports may have started on PC, but the economics in Southeast Asia told a different story.

Let’s look at the numbers. In 2024, the median annual salary in the United States was $59,228. In the European Union, the average hovered around $30,000 (depending on the country). In comparison, the ASEAN average was approximately $6,564.

With such a disparity in income, it’s no surprise that many in Southeast Asia simply couldn’t afford a powerful gaming PC. And while PC hardware prices have continued to climb—often with underwhelming performance gains—smartphones have done the opposite. Year after year, mobile devices get better and cheaper.

By 2024, the average smartphone penetration rate in ASEAN had reached 78%, and in youthful markets like Indonesia, it’s on track to hit 97% by 2029. Entry-level Android phones now cost less than $150 USD, making them the default gaming device for millions who couldn’t even consider buying a gaming PC or console.

Smartphones didn’t just close the gap—they opened the floodgates.

Mobile Games: Accessible, Stable, and Optimized

Hardware aside, the nature of the games themselves also plays a crucial role.

Compare this: many 2024–2025 AAA games on PC—especially those built with Unreal Engine 5—struggle to run smoothly even on high-end hardware. Issues like micro-stuttering, shader compilation problems, and unoptimized settings plague the experience.

Every year, PC gaming raises its system requirements, often without a proportional increase in visual fidelity.

Mobile games, however, are built differently.

A mobile game released in 2022? You can likely still run it smoothly on a 2018 phone. Even newer titles from 2025 rarely leave behind older devices. That’s because most mobile games operate on a free-to-play model, and to survive, they must run on as many devices as possible.

Why? Because even if only a small percentage of players make in-game purchases, with a massive player base, that small percentage is enough to generate huge revenue.

In contrast, PC gaming—especially the AAA segment—is built around box sales and hardware partnerships. Higher requirements mean more graphics cards and CPUs sold. It’s a different business model, with different priorities.

Why Big Numbers Matter

So far, we’ve talked about why mobile gaming is more popular in Southeast Asia. But how does that translate into an esports phenomenon?

Here’s the answer: esports needs scale. And scale needs accessibility.

Only a tiny fraction—typically the top 1%—of a game’s player base ever competes at the highest level. If your game has only 1,000 monthly active users, you’ll get maybe 10 players who are “pro-level.” That’s not enough to build a viable scene.

Let’s break down some real numbers.

- League of Legends has 150–180 million monthly active users, but its peak Worlds viewership in 2023 was 6.8 million—only around 4.5% of its player base.

- Mobile Legends: Bang Bang (MLBB) has 110 million monthly users, yet its peak tournament viewership was about 5 million—around 4.5–5%.

That 4–5% conversion rate from players to viewers is pretty standard in esports. But to get 5 million viewers, you need over 100 million players. That’s the magic of mobile in Southeast Asia. The accessibility brings in the numbers. And those numbers make esports viable.

Cultural Context: Why SEA Embraced Mobile Gaming

Beyond devices and games, culture also plays a defining role.

In the West, mobile games are often seen as second-rate. Critics dismiss them as unoriginal, riddled with loot boxes, graphically inferior, or even pay-to-win. To many Western gamers, mobile games aren’t “real games.”

But in Southeast Asia, things evolved differently.

Since the early 2000s, the region has been saturated with free-to-play online games—mostly from Chinese and South Korean developers. These games shared many of the same traits seen in today’s mobile titles.

For Southeast Asia, this wasn’t a bug—it was the norm. These design choices weren’t rejected. They were embraced.

This cultural baseline paved the way for mobile gaming—and by extension, mobile esports—to be seen not as inferior, but as mainstream.

Publishers Who Care

Lastly, let’s not forget the role of game publishers—arguably the most decisive force in any esports ecosystem.

As I discussed in another article comparing esports to football, publishers have near-total control over the destiny of their game’s competitive scene. Without their investment, support, and infrastructure, even the most passionate communities struggle to keep a scene alive.

Let’s look at some comparisons:

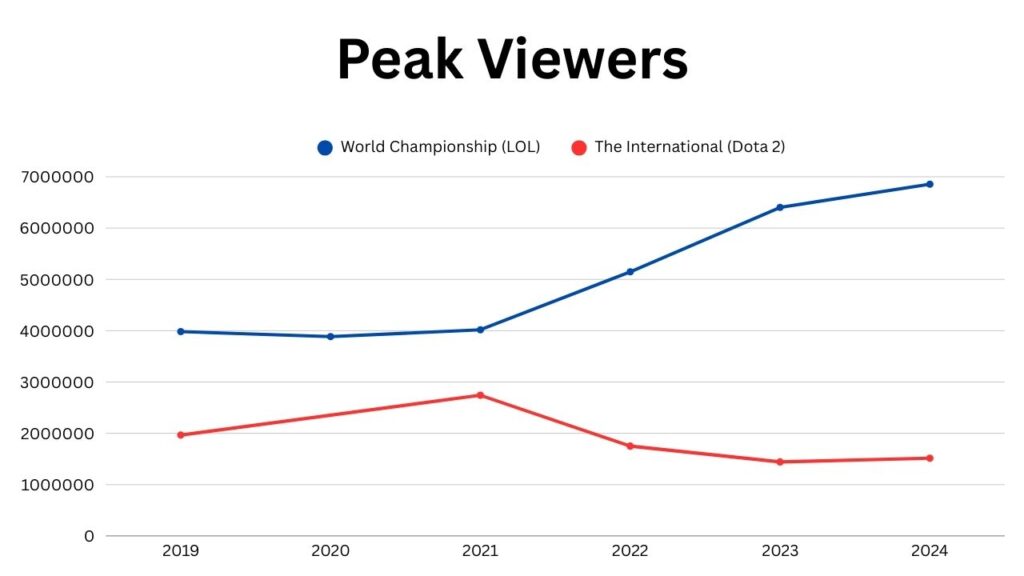

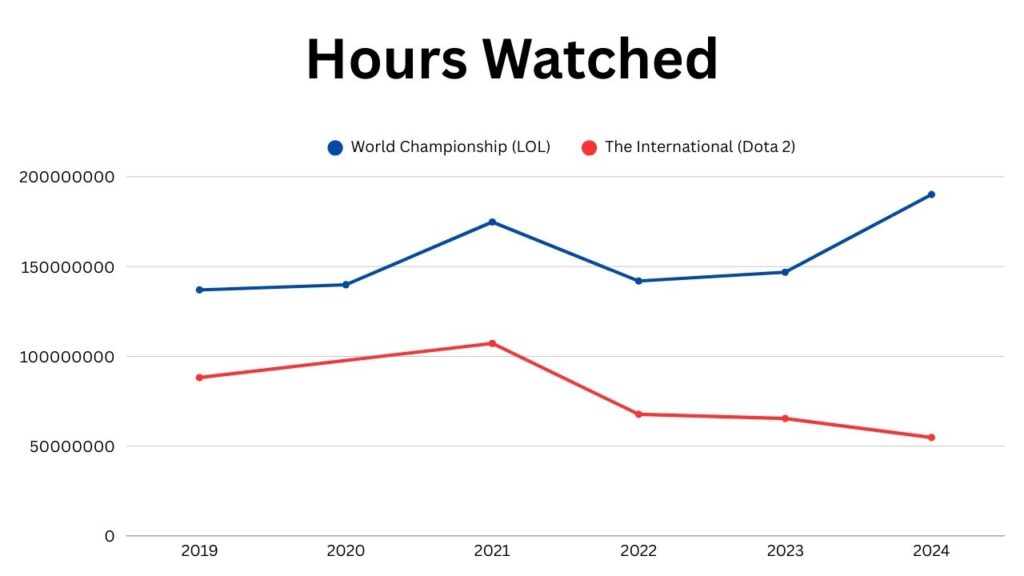

- Valve has been heavily criticized for its hands-off approach to Dota 2 esports in recent years.

- Riot Games, in contrast, continues to pour resources into League of Legends and VALORANT, building global leagues, supporting regional scenes, and maintaining consistent content and production quality.

The numbers from Esports Charts back this up. While Dota 2’s metrics have declined, League’s remain strong and steady. Publisher support makes all the difference.

| The International | Prize Pool | Hours Watched | Peak Viewers |

| 2024 | $2,573,695.00 | 54,805,111.00 | 1,513,877.00 |

| 2023 | $3,287,253.00 | 65,399,782.00 | 1,442,274.00 |

| 2022 | $18,930,775.00 | 67,739,325.00 | 1,750,253.00 |

| The International 10 (2021) | $40,018,195.00 | 107,239,277.00 | 2,741,514.00 |

| 2019 | $34,308,060.00 | 88,202,849.00 | 1,965,328.00 |

| LoL World Championship | Prize Pool | Hours Watched | Peak Viewers |

| 2024 | $2,225,000.00 | 190,138,692.00 | 6,856,769.00 |

| 2023 | $2,225,000.00 | 146,870,314.00 | 6,402,760.00 |

| 2022 | $2,225,000.00 | 141,943,968.00 | 5,147,701.00 |

| 2021 | $2,225,000.00 | 174,826,794.00 | 4,018,728.00 |

| 2020 | $2,225,000.00 | 139,888,873.00 | 3,884,667.00 |

| 2019 | $2,225,000.00 | 137,008,382.00 | 3,981,706.00 |

Now apply that to Southeast Asia.

Some publishers ignore the region, focusing instead on bigger-spending audiences in North America, Europe, China, or South Korea. And from a business standpoint, that’s fair. It makes sense.

But thankfully, not everyone followed that path.

Moonton, Garena, and Tencent have invested heavily in Southeast Asia. From regional tournaments to dedicated marketing and local partnerships, they’ve ensured that mobile esports not only survives here—it thrives.

Conclusion

Southeast Asia didn’t force its way into esports by following the footsteps of the West. Instead, it carved its own path—shaped by the realities of income disparity, shaped by a mobile-first culture, and empowered by publishers who saw potential where others didn’t.

Cheap yet capable smartphones became the entry point. Accessible and optimized games became the playground. Cultural acceptance and community passion built the audience. And publishers, willing to invest in this vibrant market, built the stage.

It’s the new face of esports. And Southeast Asia is leading the charge.